Is “Buying the Dip” Now?

Summary

No surprise there is more talk of a recession and market volatility.

- Yet, retail investors are “buying the dip” to invest for the long term

- What are my options then? US Govt Debt and Oldies, but Goodies

- Advice from Charlize Theron: Don’t be afraid to get loud

Today’s newsletter is 297 words, estimated reading time: 2 minutes

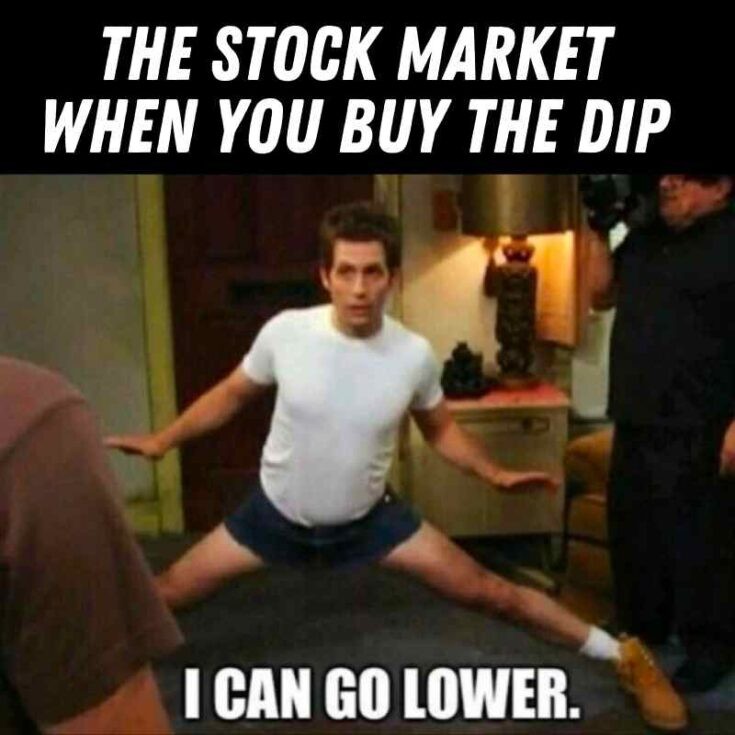

“Buying the Dip” as the Market Slides

Retail investors are “buying the dip” aka trying to buy low during this volatile period. Yet, stocks, ETFs, and other investments prices continue to sink lower.

According to the WSJ, “U.S. households have poured more money into U.S. equity mutual funds and ETFs than they have pulled out for the year.”

What does this mean?

This is a sign that retail investors are buying for the long haul to shore up their accounts. The frenzied buying during the pandemic is gone.

What do I invest then?

Volatility is making U.S. govt debt look mighty sexy at the moment.

The 2 year Treasury Note is earning an interest rate of 4.25%. The 26 week Treasury Bill is earning 3.603%.

Both of these rates are higher than CDs (certificates of deposit) and savings accounts.

The minimum to get started is even lower than alternatives at $100 and the holding period is short. You can buy these US government debt at treasurydirect.gov or your brokerage (e.g. Schwab or Fidelity, not Stash or Robinhood).

If you’re using your broker, be sure you’re buying the new auction items which come up weekly to monthly. Otherwise you may be paying more for secondary products.

More details on how to buy can be found here. (Hint: treasurydirect.gov is the same place to buy i-bonds 😉)

Want stocks?

Focus on high quality stocks, which means strong cash flow, balance sheets, and market leaders. This means oldie, but goodie companies such as Apple (AAPL), Google (GOOG), Microsoft (MSFT), and Starbucks (SBUX).

Get a free trial of emvest.ai

In the next few weeks, emvest.ai is launching the next phase of our product. Try it out and see if it boosts your investing tactics and knowledge.

Sign up here to try the product in a few weeks.

Quote of the Week: Making Space for Yourself

“The majority of my 20s and my 30s…was a time where you had to be a loud bitch to just find some space in the room.”

Actor Charlize Theron

#fintech #investing #money #moneymatters #financialindependence #wealth